The world economy stumbled at the finish of 2006

Emzar Jgerenaia, TSU professor

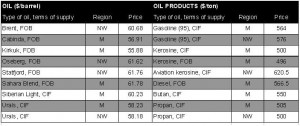

Temporal drop in petrol consumption in China has become a determinant of the international business climate. As a rule, 6 million barrels was daily consumed in China, which is more than 7% of the world consumption (86 million barrels), and this indicator was growing by 15% every month.

However, in August and September the growth decreased to 7%, which, in its turn, has seriously reduced the demand for oil products.

– In view of the heat, Nigerian rebels had a time-out and, correspondingly, the situation was stable here.

– Serious supplies of Iraqi oil to the world market have started.

– The situation around the Iranian crisis is in clinch and is characterized by an uncertain lull

– A comparative peace has set in in the Middle East with deployment of the peace-keeping contingent in Lebanon.

– In view of the aforementioned factors, the speculative agiotage was eradicated.

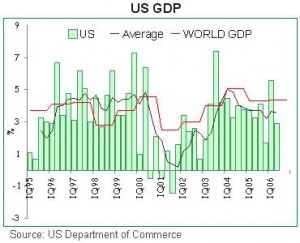

These factors reduced oil price by 20% and in the second half of September it ranged around 60 USD. As a result, it was followed by a decline in oil shares’ quotation. Besides, according to the International Monetary Fund’s forecast, the growth of the world economy will be less than it was expected. The IMF published new forecasts, according to which it is expected that in 2006 the world economy will grow by 5.1%, and in 2007 – by 4.9%. The assumed figures exceed by 0.25% the International Monetary Fund’s April data. However, the IMF warns of disruption of the global balance, which has to do with the US budget deficit and China’s huge trade profits. The report was published in Singapore, at the annual meeting of the International Monetary Fund and the World Bank.

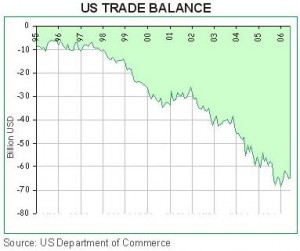

Economic growth in the countries that are rich in oil will remain at the same level, the trend of improvement of Euro zone’s economy will continue, but it is pointed out that that the growth of German economy will slow down. The same forecast applies to the US as well, where the expected slowing down of the economy will make up from 2.9% to 3.4%. The mentioned factors will have an effect on the growth of the world economy. Disruption of the trade balance is considered as the most hazardous thing. China’s trade profits in August reached 18.8 billion USD, while the deficit of the world’s largest economy makes up 64 billion USD. One of the reasons for that is weakness of the Chinese currency, which makes China’s export very cheap and gives an advantageous position to China.

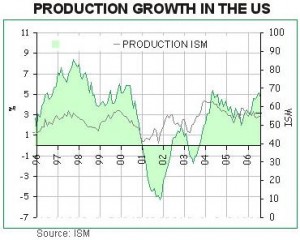

The production index is declining

The evidence of that is the drop in the US economy. In the second quarter of 2006 its growth made up 2.9%. According to the data of the Department of Commerce, the GDP growth in the first quarter made up 5.6%. Dollar’s exchange rate was declining, the Federal Reserve System did not raise the exchange rate (5.25%) and will not return to this issue till the end of October (24-25) when it is planned to hold its next meeting. The deficit of the US trade balance has traditionally increased – according to the second quarter’s data, it makes up 218.4 billion USD. According to the August data, the volume of construction of new houses decreased by 6% to 1665 units, in July this figure made up 1777,2 (the data of the US Department of Commerce).

The drop in the domestic market means not only reduction of investments in house-building. The threat consists in the fact that weakness of this market may cause the reduction of consumer expenditure, which will be a precondition for weakening of the economy. The “chain” may be formed form as follows: the low level of demand for flats may cause a drop in their prices. This will entail a decline in financial self-sufficiency of flat owners, who represent the main part of American population, and reduction of housing credits.

In the recent past, increasing of flat prices and low interest rates made it very attractive to get a credit on a security of a flat that had already been bought out by the owner and was considered as his property. However, decreasing of prices and rising of interest rates slowed down this process. If flat prices fall considerably, flat owners will not want to take credits by means of pledging their flats. Besides, there is a big threat related to rising of interest rates on hypothec loans, this growth means monthly rising of interest payment and there is a possibility that some borrowers will not be able to make it.

Is a paradox, but on Friday, September 22, against the background of undesirable results on the shares market, the construction sector showed high results. During the day this sphere’s index rose by 1.93%. One of the largest house-building companies declared that its incomes in the third financial quarter, which ended on August 31, rose by 5,5% in comparison with the same quarter of the last year, i.e. to 2,67 billion USD. At the same time, the number of sold houses was smaller in comparison with the same quarter of the last year. The number of received orders was also by 53% smaller compared to the last year’s corresponding period. “The keener competition among house-building companies, disbalance in supply, demand and market accessibility have had a negative effect on the number of sold flats, incomes, prices and orders”, said this company’s chairman in its comment. According to his words, he does not expect that market conditions will improve considerably in the near future. Nevertheless, on Friday this construction company’s shares rose by 1,20 USD to 44,25 USD, i.e. by 2,79%. At the same time, the price of other construction companies’ shares rose as well.

The forecast concerning employment has not proved to be correct either. The economic indicators published before, except for the domestic market, give a possibility of expecting a positive scenario. The index of rising of new jobs’ number – (+121 thousand in July and +128 thousand in August) was, of course, a modest one in comparison with the rate of “a strong economic growth”, but it was not a bad one in “normal growth” conditions. As to the unemployment rate in August, it was low (4,7%).

In August the inflation indicator rose by 0.2%, and taking into account energy carriers and consumer prices, it makes up 0.4%. The stock index decreased by 0.2%.

As a rule, in October they expect publication of quarterly data of the leading companies, so traders do not hasten to make investments in the US companies. Besides, many of them are in crisis; for instance Dell, which is one of the leading high-tech companies, has problems related to laptops. It did not submit technical data to the exchange in time, because of which they threat to withdraw it from quotation.

On September 22, at Friday trade, the US stock market continued the recent drop in prices after the negative data on production activity in Philadelphia was published. According to the day’s data, the index of “blue chips” decreased by 25,13 points to 11508,10, i.e. by 0,25%. ,,Nasdaq Composite” index, dominated by high-tech companies, dropped by 18.82 points to 2218.93, i.e. by 0.84%.

Philadelphia’s September data, which was published on Thursday, was an unpleasant surprise for the stock market. Before its publication economists believed that September production index in Philadelphia and its region would be 15.0 in comparison with 18.5 in August. However, in reality in September the index fell to 0.4. All rates of the index that are above zero show the rise of production activity, while the ones below zero – its decline. In accordance with economists’ forecast, production activity in the region was to slightly decrease in September in comparison with August. The indicator obtained in reality also showed the decline in this activity.

In spite of the regional character of Philadelphia’s data, it has made a weighty impression on the stock market. The main question of American stock market in the recent months is as follows: where will the drop in America’s economic growth lead to?

Retail sales in August, except for the sales of motor-cars, increased by 0,2% in comparison with July; retail sales in August, except for the sales of petrol, increased by 0,4%, while in July the increase made up 4,3%. In August the level of production at plants and factories showed a zero change in comparison with July, but in July this indicator increased by 0,4% (after it had increased by 0,9% compared to June). Thus, the data of the last two months showed not excellent, but still acceptable picture.

Proceeding from this, they expected a similar index in Philadelphia in September as well, but obtained a negative one. Instantly there appeared opinions that the situation in the US economy deteriorated in September.

Investors welcomed the quarterly account of the largest sports clothes producing company “Nike”. It is true that in the first financial quarter, which ended on August 31, “Nike’s” net profit drooped by 13% compared to the same quarter of the last year, i.e. to 377,2 million USD or 1,47 USD in shares, but the received profit has exceeded the analysts’ forecast. The profit reduction was stipulated by the increase of marketing expenditures, mainly because of the football world championship, and the increase in fuel prices and labor cost. The company’s incomes have increased by 9% compared to the same quarter of the last year, i.e. to 4,2 billion USD. At the same time, incomes in the US have increased by 6%, in Europe – by 4%, in Asia-Pacific region – by 13%.

It is noteworthy that the account of the financial quarter that ended on August 31showed the desired picture. The four largest investment banks (Goldman Sachs, Lehman Brothers, Morgan Stanley, Bear Stearns), the largest trading networks of the US dealing with home appliances (Best Buy and Circuit City), and FedEx – one of the largest express mail and transportation operator also declared about the successful results of the past financial quarter.

The US will fall short of the two devoted political allies – the former is the resigned Japanese Prime Minister Dzyunitiro Koidzumi who, in our opinion, was one of the most serious politicians, in spite of his strange haircut, and all positive reforms that has been carried out in the recent period are associated with his name; the latter – Tony Blair who has already declared that he will leave the post of the British Prime Minister next year.

The decrease in oil prices has enlivened European production and trade of the last month. However, the energy issue becomes a decisive one again. Russia has made big problems to the two largest European companies – Total and Shell.

Russia threatens not only Georgian economy, it also makes imperial problems (in the Russian style) to the world’s giants

In fact, at the end of September Shell’s 20 billion project in “Sakhalin-2” natural gas field was under the threat of stoppage. Allegedly, the ecological situation is not clear, whereas the whole of Russia is the zone of ecocatastrophe and destruction. In reality Russia wants to get a share of this business, 50% of which belongs to Shell and 59% – to Japanese companies Mitsui and Mitsubishi. At the same time, the project must begin to work in 2007 and all the contracts, according to which Japan will supply gas to Korea, have already been sold out. Russia wants to get 30% of shares plus one share, i.e. the so called “blocking share holding” and now it remembered that President Yeltsin concluded a disadvantageous contract.

Total has a similar problem in “Sakhalin-1”. Russia asks for a share in the project and they want Gazprom to be represented everywhere. Russia has proved once again that it has a dictatorial economy and here one can expect anything – from banning of Georgian wines and mineral waters to conservation of Total’s and Shell’s projects or taking away of a share.

It was the key issue during Mr. Putin’s European trip. Jacque Shirak and Vladimir Putin spoke about Total only and Russia “promised” to take measures. German Chancellor Angela Merkel was also there since she needs support for the northern gas pipeline project since it is criticized by the European Union. It is natural that against this background these leaders and Europe in general, which is traditionally dependent on Russia in many respects, do not clearly support Georgia’s interests and do not recognize Russia’s open annexation in the XXIth century. The report of the Georgian President at the UN session was nearly the ascertaining that they, together with the West, should either help to convince Russia to stop the annexation of Abkhazia and Ossetia and lift the economic blockade by means of civilized negotiations, or Georgia will protect its territorial integrity by itself. America’s support at this conference was evident, and that of Europe – a reserved one. It is interesting what is more important for old Europe – protection of ideals of democracy and freedom or Russia gas?

Russian economy is obviously a state-dictatorial one by character. According to the data of the international research agency Fitch, Russia was listed among the countries having a bank crisis, and there are only five of them in the world. Growing of credits at high rates was named as the reason for the bank crisis. Among other countries having the crisis are Azerbaijan, Ireland and South African Republic. However, Russian experts do not agree with the agency’s conclusion. According to Fitch’s appraisal, the countries where the growth rate of loans exceeds 15% belong to the risk group, in 2006 in Russia this indicator makes up 24%. As to strengthening of the Russian ruble, which started at the beginning of the current year, Russia’s citizens can see it well. The agency’s analysts consider this factor as yet another proof of “the pressure existing in the banking system” and point out that Russian banks are still weak and need help on the part of the government and shareholders. Foreign experts give a warning to Russia and make a forecast that a serious crisis can break out in the Russian banking system in the coming six months.

European Business magazine

Taming of the bear

(At G8 summit in St Petersburg, the development of trade relations between Europe and Russia turned into a critical issue)

What kind of deal with Russia should exist?

This question is very painful for European politicians and reached its peak during the cold war, when Russia, as a part of the Soviet Union, represented the hostile camp. Today everything is painted in gloomier colors. The US Vice-President accused Russia of energy blackmail and disrespect for democratic principles, while Mr. Bush’s administration gives a strongly negative appraisal to President Putin’s regime. However, it is difficult for the US and EU to escape from reality – rising of oil and natural gas prices has added irritating impudence to the Russian bear. Russia’s neighbors’ were the first to experience cudgel over their heads. In January, which is the coldest month of the winter, Gazprom cut off gas supplies to Moldova, Georgia and Ukraine – the countries that are trying to get out of Russia’s economic control. Warm relations between Tbilisi and the US badly irritate Moscow. Russia bans the export of Georgian and Moldovan wines under the pretext of non-observance of sanitary norms, Georgia suffers additional big losses because of banning of “Borjomi” mineral water, which represents a brand and is Georgia’s major export commodity. Russia threatens that it will block the US natural gas project in the Barents Sea if the US does not allow Russia to enter the World Trade Organization. Russian monopolist Gazprom badly irritates the West, Dmitry Medvedev said at the business forum in London that a strong Gazprom is useful for the world and does not conceal his wish to see the company in the whole world. It is the fourth largest company in the world and its current price makes up 250 billion USD. Relations with Gazprom represent a puzzle for western politicians. On the one hand, the free market dictates them that business should be free and act on its own volition; according to this logic, Gazprom will occupy a highly important place in the European liberal energy industry. On the other hand, with 50% plus one share of Gazprom’s share holding in the hands of the state, Mr. Medvedev being the First Vice-Premier (he is considered as President Putin’s successor) is able to control a number of TV channels and newspapers. All in all, it is hardly possible to call it a normal company, 40% of its 330 000 employees work in the spheres that are far from the energy business. According to experts, the company’s phenomenal growth is caused by the rise in natural gas prices and bureaucracy is thriving in it. However, there is a desire to reform it in accordance with the model of other companies. The company did not agree to join the European Energy Safety Chart, in accordance with which the Russian market would become equally accessible for the western energy companies.

They say in Russia that there is lack of political reforms in the country. Creation of a real civil society, problems in the education and healthcare systems, corruption, the growing gap between the rich and the poor, lack of free mass-media – this is the picture of the present-day Russia, which has become gloomier under President Putin’s rule. Russia’s citizens complain that relations with Western Europe are complicated, while Russia needs integration into the European and the world economy.

In spite of the GDP growth in some countries, such as Germany, Czechia and Poland, on the whole the rate of economic growth in Euro zone has dropped and the strengthened Euro has made problems to the export. The index of new jobs is also decreasing and more enterprises close down and transfer their activities to Asia. Europe seriously loses in comparison with Asia, especially China, in spite of the fact that they often apply non-economic methods in partnership. At Helsinki meeting the relations between Europe and China became more strained. China is blamed for exporting of cheap goods to the European market. China’s desire to obtain the EU’s market economy status still remains a desire. The President of the European Commission Jose Manuel Baroso spoke on inhibitory factors for China.

This year the bilateral trade between China and the EU has sharply increased and made up 255 billion USD, but, in spite of it, the relations between the countries has become strained since China is blamed for dumping. China’s representative maintains that obtaining of the status will be advantageous for both parts.

The index of China’s trade surplus reaches new heights

As a result of trade with other countries of the world, China’s profits have reached the record level of 18.8 billion USD, which in all respects exceeds the last months’ profits and analysts’ forecasts. The officially published figure generates more tension around the debates concerning the incorrect appraisal of the Chinese currency.

Some of China’s partners, including the US, maintain that China retains the low exchange rate of yuan with the purpose of export’s increasing.

According to the latest data, in 2006 China’s trade surplus will make up 95.6 billion USD. Americans are actively pointing out the disrupted trade balance between China and the US and emphasize that the reason for growth of the country’s trade surplus is yuan, in July 2005 its exchange rate in relation to USD increased by 2%. It is expected that China’s currency and its trade surplus will be the main subject of the annual meeting of the World Bank and the International Monetary Fund in Singapore. The country’s official representatives declare that they will take necessary measures aimed at eradication of liquidity in the banking system and improve the mechanism of formation of Chinese currency’s exchange rate.

With the purpose of control over the strengthened economy and inflation, China raised interest rates on loans twice after April.

As to the goods market, the price of gold is ranging around 600 USD/oz, in the near future the price of gold will be 577-595 USD/oz, platinum – 1100-1190USD/oz, palladium – 300-340USD/oz, nickel – 35000 USD/ton; wheat, steel, sugar and coffee have the rising tendency. According to experts, the price of meat will also rise in the fourth quarter.

Against the background of all this, in spite of the fact that the price of natural gas has decreased, which is a temporary phenomenon, curbing of inflation will be necessary in Georgia. According to the statement of the IMF, till the end of the year it will make up 14% if the Georgian government does not resort to radical measures.