IS BUSINESS MAKING AVAILABLE IN GEORGIA?

Eka Gabadadze

Despite last years’ noticeable changes in Georgian economy, economic environment for business hasn’t changed much.

Questions of improvement and socio-political development still depend on state building. It’s an axiom that improvement of economic environment is unimaginable without reforms in juridical and tax branches.

We’ve already spoken much about improvement of economic environment in Georgia, however, instead of bettering, situation has considerably deteriorated. If energetic crisis and imperfect tax code obstructed development of enterprise some years ago, now the increasing corruption and strained socio-political background joined them, including: high interest rates on bank credits obstructing investments, widespread distrust to financial institutions and well known nonprofessionalism. It’s not surprising that some may astonish of numerous changes and efforts having no positive effects.

Is business making available in Georgia?

It’s a question of all businesspersons and officials answered simply – NO. That’s a reason of most entrepreneurs, breaking their businesses off.

David Saganelidze (Parliamentarian, The New Faction, Ex-businessman): Why is too simple, as we answer – NO! There are no conditions of running legal business in Georgia. Right because of that I had to leave my business related to import. It’s difficult to make such business, when you have to pay 34,76% for customs duties and VAT, and the same goods are imported more cheaply by contraband. Tax system is totally incorrect. The only way to improvement is tax liberalization! Some think that increasing taxes twice, we’ll rise budget revenues. False. Increasing taxes twice, we’ll lessen revenues four times and extend corruption about the same times! Everything we’ve done in Customs and Tax Departments is superficial, giving no result!

David Salaridze (Parliamentarian, Faction “Industry Will Save Georgia”): – I remember the process of tax code formation well. Even in period, when I worked for Tax Department only three instructions existed for taxation. Later, we accepted three or four Laws and in 1996, with the help of International Institutions – tax Code of Georgia. Thereof, relying on world’s experience, we know that 20% VAT is not the highest, but too hard for Georgia. Existing tax rates are acceptable for highly developed and civilized countries only. Which of profitability can we speak, when the owner of supermarket, for example, has to pay 200 GEL even for local electricity, or who can produce lemonade, if amounts from banks are credited at 2,5% interesting rate per month, and the same product works at 2% per year if imported? Leaving our business in this stage and providing no protectoral policy, we bury our industry. GDP, this year, comprises 5,5bn GEL, the same is our debt! Thereof, country that has equal GDP and debts may be announced as bankrupt. Moreover, imperfect legislation and energetic problems are added with illiteracy and nonprofessionalism! Unfortunately, a few of our entrepreneurs are familiar with market language.

Besides all, nonprofessionalism remains at the heart of hot allegations in Parliament:

– I haven’t seen even the one serious document that could change tax code radically! – Declares David Saganelidze, – all is on level of experiments. Uncertified and blown figures only! Unfortunately, Parliament has been complicated by people mistake of, which may cause absolute break off for business! Most of them even have no imagination about business and production.

Entrepreneurs appraise their resources

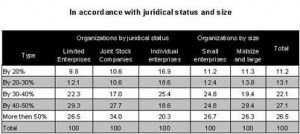

Comparing to figures of previous years, appraisal of productive forces in private sector has improved noticeably. About half of (47,8%) enterprises respond to international standards with an improved state of main assets. However, the same of 43,4% in state ownership does much bad, as their assets need to be changed totally. Thereof, prior comes their privatization. With massive privatization and better economic conditions, last three years have improved the territorial and economic activity of entire environment. So, existing capable productivity indicates to obvious advance and stability, if compare to previous years. Unfortunately, stability is not always a good remark, as our country has already passed the periods of stable, but hardly criminal; stable immovability; stable with frozen pensions and wages etc. To my opinion, today’s business is in same period of stable but chaotic and inevitable state. All that’s in general. Detailed estimations shown in table 1.

Interesting estimations are presented on business profitability as well. Half of businesspersons have lost according to official information. Only 25,4% have increased their incomes. Should also be mentioned that comparing to other fields, commerce have lost much, which is caused by serious competition, to experts’ opinion.

Again taxes

Despite the years of hard work on renovations, our tax system and code are near at hand to death. It will be on the agenda until Parliamentarians consider entrepreneurs as monsters and tax code supports corruptive people. Share of unofficial taxes increase with catastrophic speed, which is caused by widespread illegal environment throughout country. More then half of entrepreneurs pay illegal taxes, however, it’s too delicate question and we don’t think most of poll questioners were sincere answering the question did they lost much or not.

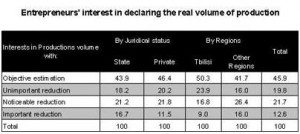

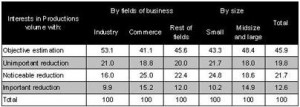

Table 2 and 3 represent the level of entrepreneurs’ interest in declaring the real volume of production.

Business lobby with distorted Georgian version

David Salaridze: – Lobby for business, is important not only in Georgia, but in the U.S. as well. Of course Georgians acknowledge it incorrectly and distort therefore! Lobby doesn’t mean the fee sharing. Parliamentarians are invited for lobbying the certain field and accepting the favorable for country decisions. Large Trans-national companies in U.S. for example, run the entire American finances. They bring up the politicians those in future lobby their businesses in the Parliament. Georgians have distorted everything. We should discard our ambition that Georgia may compete with world business. We’d be better looking for own way in new life and strategy that’s still unascertained. Georgia always had a capacity to employ three millions of population. For now, I don’t think Georgia can even imagine of 3 million jobs. We haven’t even defined the strategy of improving our lives. You may ask of famous pipeline. I agree that it’s political strategy, but not jobs. Pipeline will be more favourable for Azerbaijan then for us. As the real strategy for Georgia, our Party considers agrarian sector and farming.

David Saganelidze: – When the businessperson acknowledges that the state structures obstruct him and faces the danger of being unprotected, deals with criminals of course. Be sure that none of businesspersons desire that much. Worse is that as soon as someone starts to protect business, everyone speaks about shares and fees in companies. I don’t want anyone considering my as a pessimist, but god knows when we feel better. If scrutinizing the business environment and looking further for obstacles impeding business development, none will remain optimistic.

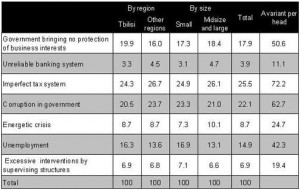

Here are the results of polling. Table 4 presents the obstacles businesspersons do consider the most impeding for business development.

Let’s divide all of them in three groups in accordance with frequency;

I group factors – more then 60% of frequently named obstacles;

II group factors – 30-60%;

III group factors – less then 30%.

In accordance with table and parameters of above grouping, obstructing factors may arrange as follows: corruption in government 63%; Government bringing no protection of business interests 51%; unemployment 42%; energetic crisis 25%; Excessive interventions by supervising structures 19%; Unreliable banking system 11%.

All highlighted above indicates that the most of businesspersons does not agree with existing tax rates. At the same time, before speaking about imperfect tax system entirely, we’d better work for the improvement of its basic part the tax code.

Besides remarks by businesspersons, economic scientists are presenting the same factors. However, it’s difficult to forecast how government will stipulate these remarks. What will the perspectives of the third millenium be is still undiscovered.